ICRA has reaffirmed the long-term rating of 'A' assigned to the Rs 5.06 billion term loans (reduced from Rs 5.80 billion), and the Rs 20.72 billion fund based bank limits (enhanced from Rs 18.10 billion) of Balrampur Chini Mills (BCML).

ICRA has reaffirmed the long-term rating of 'A' assigned to the Rs 5.06 billion term loans (reduced from Rs 5.80 billion), and the Rs 20.72 billion fund based bank limits (enhanced from Rs 18.10 billion) of Balrampur Chini Mills (BCML).

ICRA has also reaffirmed the short-term rating of 'A1' assigned to the Rs 5 billion commercial paper/ short term debt programme and Rs 543.7 million non-fund based limits (reduced from Rs 650 million) of the company. The outlook on the long term rating has been revised from negative to stable.

ICRA has also reaffirmed the short-term rating of 'A1' assigned to the Rs 5 billion commercial paper/ short term debt programme and Rs 543.7 million non-fund based limits (reduced from Rs 650 million) of the company. The outlook on the long term rating has been revised from negative to stable.

The revision in the outlook factors in the significant increase in domestic sugar prices recently, and the expected improvement in the domestic demand-supply scenario during sugar year† (SY) 14 after the announcement of a subsidy of Rs. 3300/ tonne by the Central Government for production of raw sugar for exports, which is likely to ease pressures on domestic sugar stock position and support prices in the near term. ICRA therefore expects the company's near term profitability and cash accruals to improve from earlier estimates. The ratings continue to factor in BCML's large scale of sugar operations with operationally efficient sugar units and forward integration into cogeneration and distillery businesses, which provides alternate revenue streams and reduces the impact of the cyclicality of the sugar business to an extent.

ICRA notes the availability of adequate bank limits to support the company's working capital intensive operations and also further funding support by way of availment of interest free excise duty loans under a scheme announced by the GoI. Although the UP State Administered Price (SAP) for cane has been kept at previous year's levels at Rs. 280/ quintal for SY14, the actual cost of procurement would be lower for UP based sugar mills, including BCML, for the sugar year 2013-14 vis-a-vis SY 2012-13, given the various waivers in taxes and duties offered by the GoUP to the sugar mills in the State.

The ratings are however, constrained by the fact that profitability of UP based sugar mills will continue to remain vulnerable to the Government of UP (GoUP) policy on cane prices, given that they are largely fixed without any reference to prevailing sugar prices. This apart, profitability of sugar mills will also remain vulnerable to the cyclical nature of the sugar industry and the agro-climatic risks related to cane production. ICRA however, understands that the GoUP is contemplating offering some subsidies to sugar mills in the current sugar year and also has set up a committee with a view of rationalizing cane prices. The success of these initiatives will be key to restoring the financial health of the sugar sector in the state and ICRA will continue to monitor further developments in this regard.

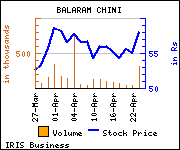

Shares of the company declined Rs 0.85, or 1.46%, to trade at Rs 57.20. The total volume of shares traded was 106,763 at the BSE (2.18 p.m., Friday).